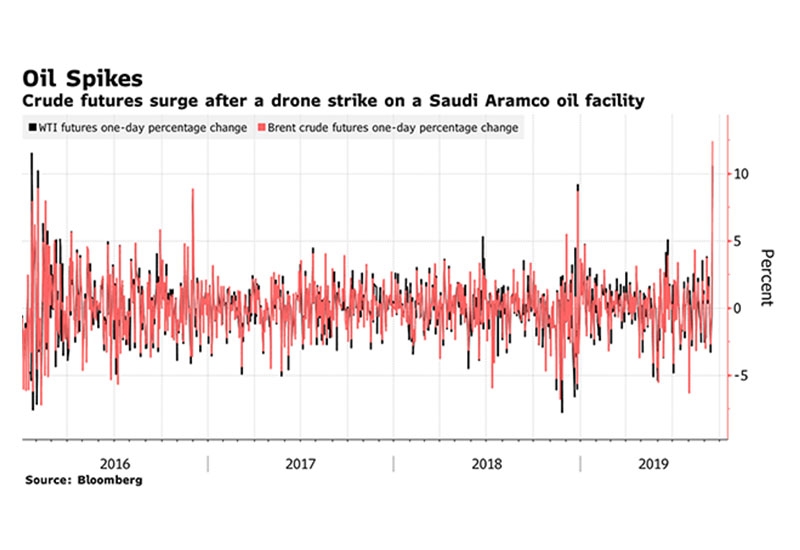

Oil Prices Jump on Record After Saudi Arabia Strike

Oil posted its biggest ever intraday jump to more than $71 a barrel after a strike on a Saudi Arabian oil facility removed about 5% of global supplies.

For oil markets, it’s the single worst sudden disruption ever, and while Saudi Arabia may be able to return some supply within days, the attacks highlight the vulnerability of the world’s most important exporter.

“We have never seen a supply disruption and price response like this in the oil market,” said Saul Kavonic, an energy analyst at Credit Suisse Group AG.

The dramatic move in oil reverberated around financial markets. Haven assets including gold and Treasury futures surged on concern over the geopolitical fallout from the attacks. Currencies of commodity-linked nations including the Norwegian krone and the Canadian dollar also advanced. U.S. gasoline futures jumped almost 13%.

The drama wasn’t limited to flat prices. The spread between Brent and WTI widened as much as 37%, showing that the oil spike will affect global prices more than those in the U.S., where shale output and ample supplies provide more of a buffer.