Oil Experts See WTI In $50-70 Range This Summer

Source: CNBC

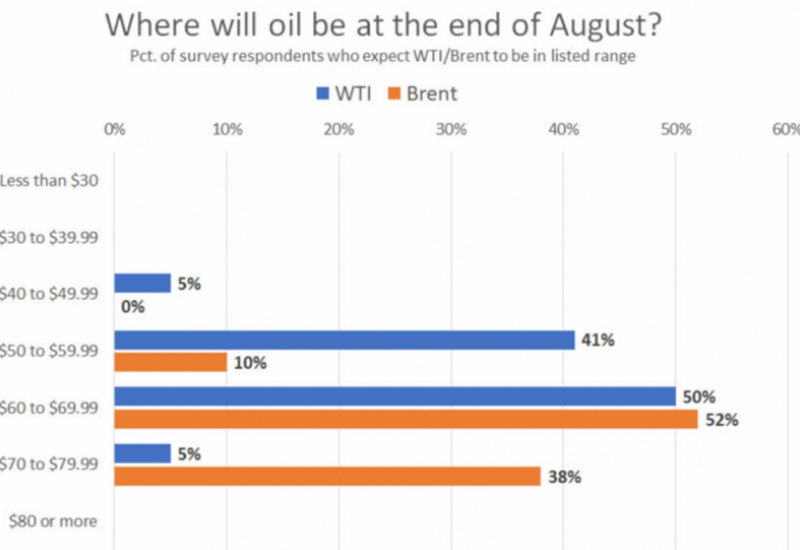

50% of oil experts surveyed by CNBC expects WTI Crude to trade between $50 and $70 a barrel at the end of August, and most analysts see demand and trade disputes as the biggest driver of oil prices right now, despite escalating tension between the U.S. and Iran.

Another 41% expect WTI in the $50-60 range - the range in which the U.S. benchmark has traded since January this year.

The CNBC survey also found that 52 percent of oil experts see Brent Crude in the $60-69.99 range, where prices have mostly stood this year. Another 38 percent of analysts see Brent prices in the $70-79.99 range at the end of August.

A total of 41% see global demand as the single biggest driver of oil prices now, while another 18% see the U.S. trade disputes with other countries as the determining factor for oil prices. Just 14% of experts polled see geopolitics as the single biggest driver of the price of oil.

A total of 36% of respondents don’t expect the U.S. and Iran to get to a military confrontation, while 23% expect limited missile strikes. Another 18% expect skirmishes in the water, and only 9% see a major conflict or massive strikes coming.