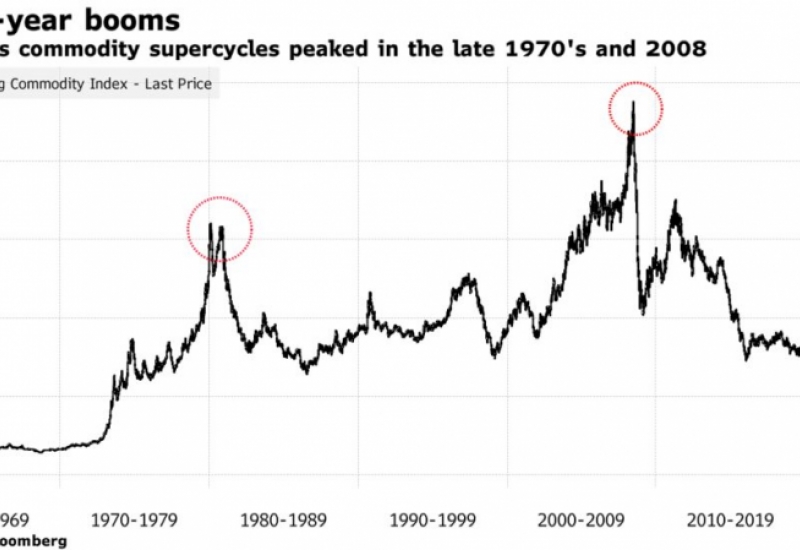

JPMorgan: Commodities May Have Just Begun a New Supercycle

Source: Bloomberg

With agricultural prices soaring, metal prices hitting the highest in years and oil well above $50 a barrel, JPMorgan Chase & Co. is calling it: Commodities appear to have begun a new supercycle of years-long gains.

A long-term boom across the commodities complex appears likely with Wall Street betting on a strong economic recovery from the pandemic and hedging against inflation. Prices may also jump as an “unintended consequence” of the fight against climate change, which threatens to constrain oil supplies while boosting demand for metals needed to build renewable energy infrastructure, batteries and electric vehicles, the bank said.

Commodities have seen four supercycles over the past 100 years – with the last one peaking in 2008 after 12 years of expansion. While that one was driven by the economic rise of China, JPMorgan attributed the latest cycle to several drivers including a post-pandemic recovery, “ultra-loose” monetary and fiscal policies, a weak U.S. dollar, stronger inflation and more aggressive environmental policies around the world.

Source: Bloomberg